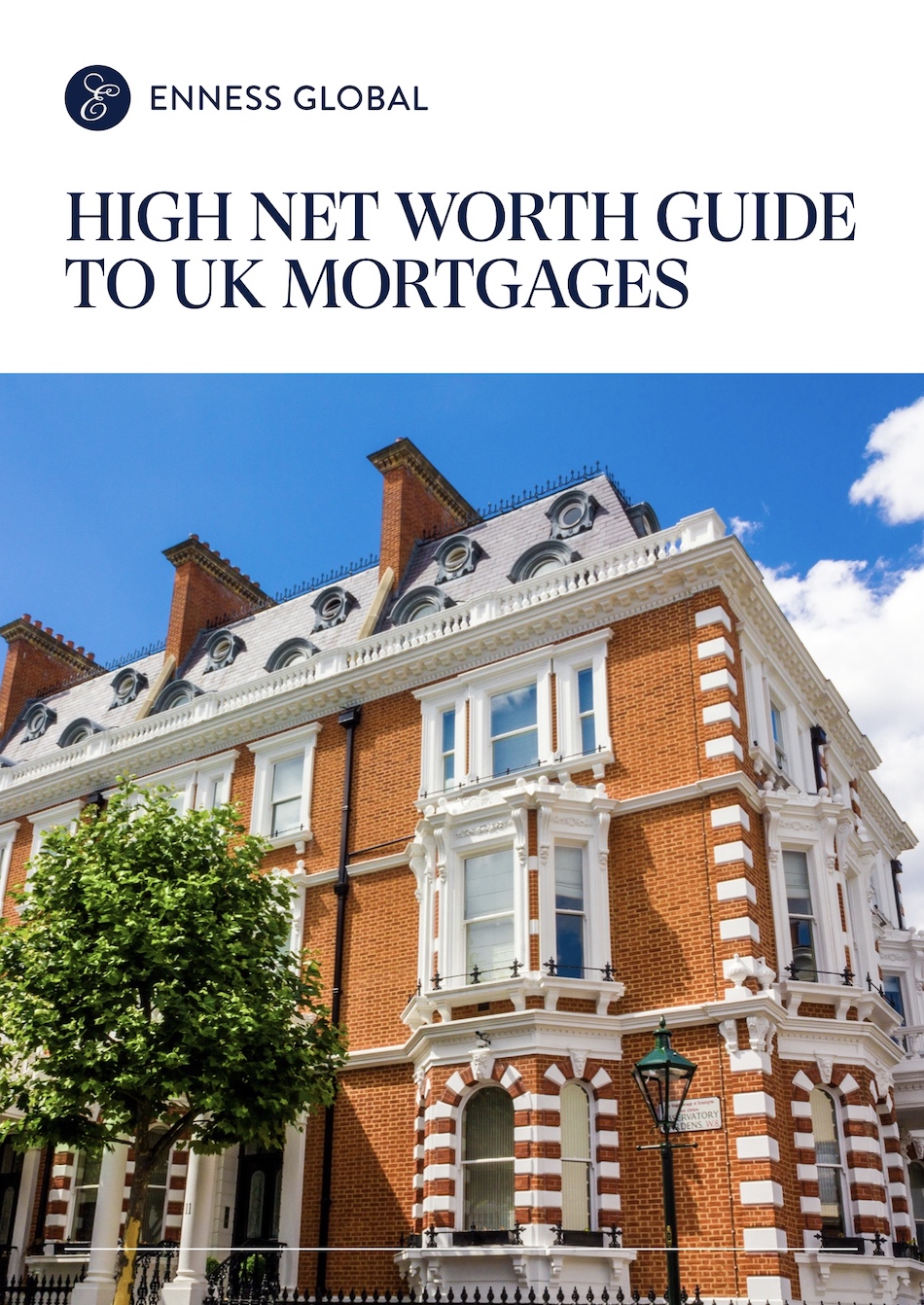

High Net Worth Guide to UK Mortgages

This Enness Guide is free to download and can be accessed as soon as you complete the form.

About Guide

The UK is home to one of the most liquid, competitive, and complicated mortgage markets in the world.

There are hundreds of mortgage providers who lend in the UK, from major international banks to niche building societies and alternative lenders. Each lender has their own specialisation and position in the market where they excel. They also have lending criteria, interest rates, processes and oddities which are specific to them.

The UK has a considerable number of lending channels. There are regulated mortgages, unregulated mortgages, buy-to-let finance, bridging finance, commercial mortgages and more. It’s easy to see why the lending market is so complicated. The UK’s finance options are plentiful. There are huge pools of liquidity (some of it incredibly cheap) and you can enjoy flexible lending terms. If you are a foreign national, expat, a high-net-worth individual, are self-employed, have significant assets but relatively low taxable income or anything in between, the UK mortgage market will have an option for you.

This Guide Covers

- Million pound plus mortgages

- Private bank mortgages

- Large buy-to-let mortgages

- Interest-only mortgages

- High-value property equity release

- Complex mortgages

- High loan-to-value mortgages

- Self-employed mortgages

- Foreign currency mortgages

Who are Enness?

Established over a decade ago, Enness has earnt its place as the market leading high net worth (HNW) international mortgage brokerage.

In addition to securing finance and protection, our dedicated and multilingual team is well versed in helping clients make the most of their high value assets – be that releasing capital for onward investment, or improvements to the existing property.

Our team takes a bespoke, holistic approach, and has carefully built up an extensive network of lenders to ensure we can always secure the appropriate finance for your situation.